CRB Clearance Process In Kenya: Step By Ste Process

This article will give you a guide on how to get clearance from CRB also known us Credit Reference Bureau. The good news is that you can easily get cleared and get awarded with a certificate of clearance from CRB Bodies.

There are three companies in Kenya that offer CRB clearance services that you can go for. These are; TransUnion, Metropol and credit Info.

But first how will you know if you are listed on CRB? Well you can easily know your CRB status by getting a CRB report. A CRB report contains all your borrowing information and your loan repayment history from financial institutions among them banks and mobile money lenders.

If you have defaulted your will be listed as having a Non performing account, but if your your loan is on schedule and repaying it, then your credit report status will be active.

How to Check Your CRB Status

To check your CRB status:

- Contact any of the CRB bodies – TranUnion, Metropol or Credit Info

- Register with them by paying Registration Free

- They will instantly process your full report

- Open your your report which is commonly in PDF to access your status information

- Check for any Non-performing accounts and active accounts if they are appearing on the report.

- Save your report for future reference

- To easily get a CRB report, you can contact a CRB agency who will take you through the process.

How To get Cleared With CRB

You will need to get CRB clearance if you have a listed account. This means you have non-performing account(s) from your report. the account details will show you the default amount and days in arrears you have defaulted.

Below is the process of getting Clearance with CRB;

- Pay your loan in default

- Register with the relevant CRB body eg TransUnion, Metropol or credit Info

- Contact the CRB body or CRB agent for clearance

- From here, provide your name, ID and Phone number

- Provide details of the money lender that listed you as well

- From here, your CRB records will be updated to reflect your current status

- Should you need a CRB clearance certificate, then one will be processed for you as long as your CRB account has been updated

- You will be charged Ksh.2200 for the CRB certificate.

- A CRB certificate id valid for 12 months from the date of issue

Should you need another CRB clearance certificate upon expiry, then you can apply for another. It should however be noted that, having a CRB clearance certificate does not always mean you are in good stands with financlial institutions or the bureau. This is because your credit status can change anytime.

Metropol CRB Self Clearance Process

- Dial *433# on your mobile phone using Safaricom line

- Enter your National ID Number

- Enter an agent number if you were referred by a Metropol agent, if not eenter zero (0) and proceed

- Follow the to complete the registration process

- Pay Ksh 100 as registration fees through the Paybill number 220388 and use your National ID number as the account number

- You will receive an SMS with Crystobol PIN

- Visit the Metropol website

- Enter your PIN

- Select ‘Clearance Certificate’

- Pay Ksh 2,200 for the certificate through the Paybill number 220388

- Follow the instructions provided to download your clearance certificate

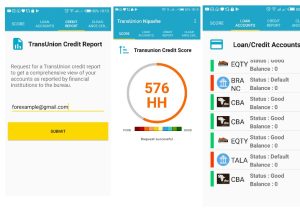

TransUnion Africa CRB Self Clearance process

- Get Sh.50 in your Mpesa wallet for registration

- Register by paying Ksh.50 to mpesa paybill number 212121 and use your National ID as account number

- Download the TransUnion Nipashe app as instructed from the SMS

- Open the App and enter your details

- Activate the App by entering the TranUnion Verification Code you will receive

- Select the Score Menu to see your credit score

- Select the Loan Account menu to see your loan account summary

- Select the Credit Report option and enter your email to receive your credit report straight to your email.

- You can get a clearance certificate by paying Ksh.2200 the select the Clearance certificate option from the App and enter your email to get your CRB certificate.

How To Get CRB Clearance From Creditinfo Kenya

Follow the instructions on their website and fill the subsequent forms thereof.

If you have any outstanding loans you will need to clear them in order to get a CRB clearance certificate. If you are not able to clear the loans at the time you will just have to get a a credit status certificate.

Trans Union Contacts

For trans union crb contacts use;

- Body: Credit Reference Bureau Africa Limited (Trans Union)

- Phone: +254730 651 000 or +2540203751344

- Email: info@transunion.co.ke

- Physical Address: 2nd Floor Delta Annex, Ring road, Westlands,Nairobi

- SMS: 21272

Metropol Contacts

Metropol crb contacts;

- Body: Metropol Credit Reference Bureau Limited

- Phone: (+254) 20 26 89 88 1 OR 0709 834 000 or 0709 228 000 or 0730884000

- Email: creditbureau@metropol.co.ke

- Physical Address: Barclays Plaza, 9th Floor, Loita Street, Nairobi

Creditinfo Contacts

- Body: Creditinfo Credit Reference Bureau Kenya Limited

- Phone: +254 735 880880 or +254 718 842833 or 0709593000

- E-mail: cikinfo@creditinfo.co.ke

- Physical Address: Park Suites, Parklands Road, Nairobi

Read>>Can you get CRB clearance without paying your default loan? All you need to know